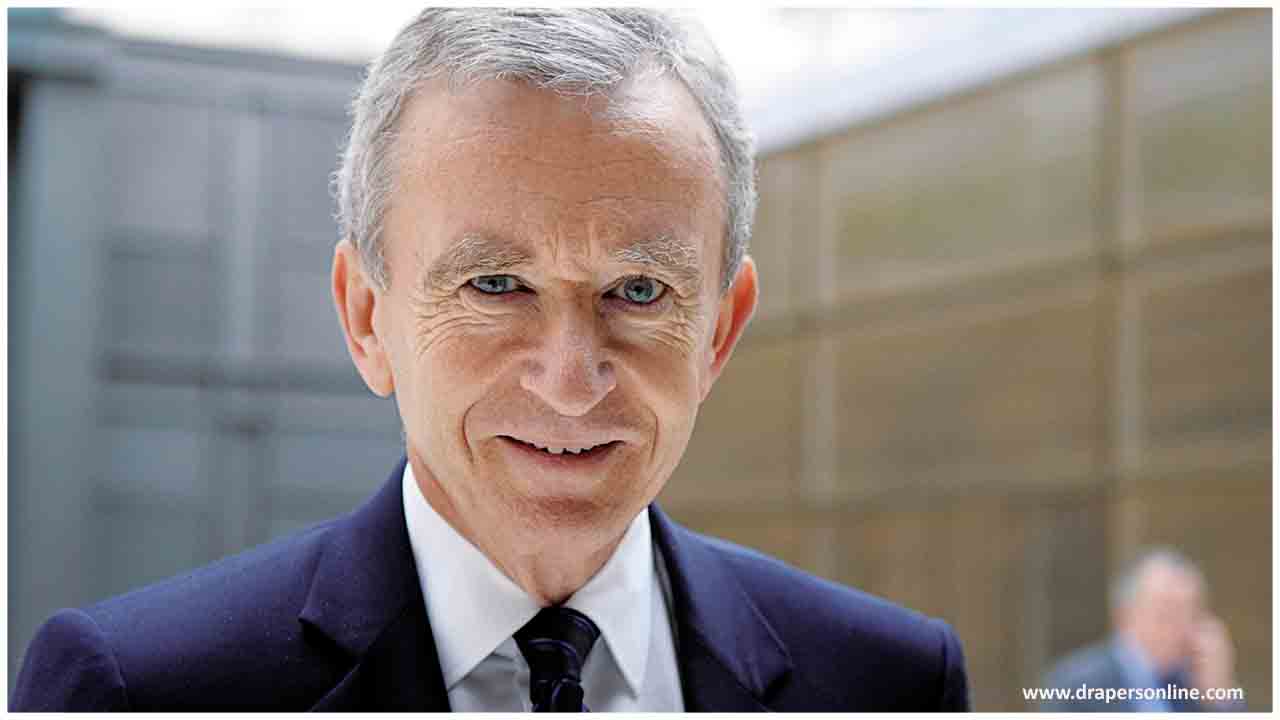

In his ninth-floor office on Paris' Avenue Montaigne, Europe's wealthiest man, Bernard Arnault, is spending extended periods plotting a post-infection future for his extravagance products domain, LVMH. At 71, the extremely rich person has survived a few emergencies, yet none very like this one, with his task force of more than 70 brands - from Dior to Fendi - hit from all sides.

Arnault's riches have plunged. With LVMH shares down 19% this year, his total assets have contracted by more than $30 billion - losing more cash than some other individual on the planet, as indicated by the Bloomberg Billionaires Index. As of May 6, he had lost about as much cash as Amazon.com Inc. Administrator Jeff Bezos had picked up.

Determined, Arnault has been going to his war room each day, where he's battling to keep a blockbuster obtaining and several pharaonic lands extends on target while holding video calls with appointees as they get ready to revive manufacturing plants and boutiques in an infection shaken the world.

"He's setting himself in a place to continue taking offer once the market returns to development," said Mario Ortelli, establishing accomplice of extravagance consultancy Ortelli and Co. in London.

Since the late 1980s, Arnault has stunned - and now and again scandalized - the tenuous universe of French business with his immense energy for turning the imagination and craftsmanship of Europe's most seasoned brands into a godsend of ever-developing benefits.

His leader Louis Vuitton brand is evaluated by examiners to have a net revenue as high as 45%. The imprint ups on that brand's monogrammed trunks and totes, just as from other brilliant goose items like Hennessy Cognac and Dom Perignon Champagne, have helped fuel Arnault's growing nearness in many things rich individuals burn through cash on Whether they purchase a Fendi purse, a Bulgari watch, or remain at Venice's Hotel Cipriani, they're adding to Arnault's coffers.

Be that as it may, as the coronavirus episode and lockdown measures to contain it dive the worldwide economy into its most exceedingly terrible emergency since World War II, being the main recipient of optional spending unexpectedly doesn't look so hot.

The greater part of Arnault's style boutiques around the globe has closed down for over a month, prompting billions in missed income in his most beneficial division. The producer of a fifth of the world's Champagne is selling much less of it with gatherings and shows dropped and dance club and cafés shut. J'adore Dior aroma is to a lesser degree a need for the worlds conceal masses.

Amidst all that, Arnault is on the snare to pay $16 billion for Tiffany and Co. in what was charged as the extravagance business' greatest ever obtaining. LVMH has pushed back at any proposal that it would leave the arrangement or renegotiate the cost after the U.S. diamond setter's business comparably slowed down.

"What's occurred with Covid-19 is an ideal tempest for extravagance," Ortelli said. "You have a withdrawal in GDP alongside expansion invulnerability."

In any case, speculators would compose Arnault off at their own risk. LVMH shares have fared better than those of Gucci-proprietor Kering and watchmaker Richemont, which have fallen 25% and 30%, individually. Arnault's brands, their succulent edges, and his money heap of around 9 billion euros ($9.72 billion) give him the adaptability to brave the emergency as well as to continue growing.

"We are especially long haul situated," LVMH Chief Financial Officer Jean-Jacques Guiony said in a meeting Thursday. "In an emergency, many individuals make statements will never be the equivalent, yet we are as yet sure."

Truly, Arnault has made a profession out of contributing through downturns when his rivals were excessively debilitated or too restless to even consider forging ahead. The downturn in the mid-2000s saw him crush Prada Group SpA out of its shareholding at his recently obtained Fendi brand. It was additionally when he propelled the primary extravagance internet business emporium and implicit Tokyo what was then Louis Vuitton's greatest ever store.

"You could isolate the world's top extremely rich people into profoundly fruitful hazard chiefs and exceptionally effective daring individuals; Arnault is a profoundly effective daring person," said Pauline Brown, the previous administrator of LVMH Americas. "At the point when he feels the energy and long haul potential, he utilizes the assets he needs to follow it forcefully."

LVMH's technique has frequently been to spend enormously to win large. As of late, a kind of interchanges race against any semblance of Chanel and Gucci has seen the organization flying several visitors each spring to runway appears far and wide, lodging them in rich tends to like the French Riviera's Hotel du Cap-Eden-Roc or Marrakech's La Mamounia resort. Such lavishness has served to strengthen the cachet of Arnault's greatest brands.

Those occasions were abandoned for the current year, alongside a significant part of the spending plan for building up the going with assortments. Promoting spending was additionally cut, alongside the following period of menswear and high fashion design shows that would ordinarily have occurred in June and July. A portion of the occasions is probably going to be supplanted by more affordable introductions on the web.

What's maybe remarkable, in any case, are the ventures that Arnault despite everything intends to keep up. With the standpoint for universal the travel industry still shady, LVMH is adhering to its arrangement to revive the Samaritaine retail establishment in Paris as an obligation free shopping center point and lavish inn. The development has continued with the 1 billion dollar venture presently focusing on a potential February opening. LVMH likewise plans to manufacture a Cheval Blanc lavish lodging on Los Angeles' Rodeo Drive.

With significant undertakings like the Samaritaine "once you've drawn in, it bodes well to finish it than to stop and start once more," CFO Guy said.

Additionally, Givenchy is pushing ahead with plans to select another architect and retool the brand's stylish in time for a September style appear - regardless of whether infection-related limitations may block assembling a group for the originator's introduction.

Conversely, Italian shoemaker Salvatore Ferragamo SpA said it suspended or dropped non-principal interests in March.

With LVMH set to report its steepest-ever decays - investigators right now expect the first-half working benefit to fall by generally half - Arnault could, in any case, make profound cuts. The organization intends to cut capital consumption by 30%-35% this year, postponing some store openings and remodels. As of now in the U.S., its Sephora chain laid off more than 3,000 individuals, or about 30% of store staff, toward the beginning of April.

While other ongoing emergencies were simply monetary, "this one is mental, and could keep going for an age," Brown said. "I believe it will require an altogether different methodology over the portfolio." LVMH's center resources are "firmly overseen, yet there is this long tail of littler brands that don't get a similar examination," she said.

In any case, with its money heap and with deals indicating green shoots of a bounce-back in China, LVMH could similarly also twofold down on contributing through the emergency. Exceptionally specific providers, prime land, and top abilities could all come available for anyone. And keeping in mind that Arnault isn't known for being a deal tracker, he'd be opposed to missing chances to add exceptional resources for his stable.

The business's destiny, and Arnault's with it, will to a great extent rely upon China, a market that is made up of more than 33% of extravagance deals and 66% of the part's development lately.

"In April, in the enormous brands, we've seen high development rates in Mainland China," Guiony said during an April 16 speculator call. "It truly shows the hunger of Chinese individuals following two months of lockdown to return to their past example of utilization."

Customer information, nonetheless, demonstrates numerous Chinese intend to spend all the more circumspectly. Furthermore, regardless of whether the repressed interest that has been designated "retribution spending" there is genuine, the lift won't be sufficient to facilitate the extravagance business' burdens.

Closer to home, Monday will give LVMH's first large test to relaunching its business in the remainder of the world, as France's lockdown estimates begin to ease. After the organization reconfigured French plants to wrench out defensive veils and cleaning hand gel - as much as 60 tons for each week - since March, the creation of its popular frill has continued.

Shops including most Sephora, Dior, and Louis Vuitton areas are set to revive, just as the Bon Marche retail chain. A Sephora representative said it increases snap and-gather alternatives, with French stores presently taking care of requests inside two hours, and introducing plexiglass obstructions at the registers.

Steps from Arnault's war room, the murmur of pressure-driven lifts, and the crashes of mallets can be heard behind platform wrapped windows at Christian Dior's establishing boutique on Avenue Montaigne. With Arnault's favoring, the celebrated house is continuing onward with plans for a general redesign that will significantly increase its size: one more wager that the business will rise once more.

Arnault's wealth has plunged. With LVMH shares down 19% this year, his net worth has shrunk by more than $30 billion -- losing more money than any other individual in the world, according to the Bloomberg Billionaires Index

Arnault's wealth has plunged. With LVMH shares down 19% this year, his net worth has shrunk by more than $30 billion -- losing more money than any other individual in the world, according to the Bloomberg Billionaires Index